Amid fears of losing its main gateway to the outside world, Uganda has stepped up efforts to amend a loan agreement it signed with China in 2015.

Back then, the land-locked country had launched an ambitious 20-year civil aviation master plan, which included the upgrade of its only international airport in Entebbe. The refurbished airport was projected to handle nearly 150,000 operations annually, making it a regional hub.

To finance the plan, the East African nation took a $325 million loan from the Export-Import Bank of China, and after Parliamentary approval of the arrangement, the work started in January 2016.

Newly emerged revelations have pointed to the dangers lying within the deal which could see the country lose its sole international airport. As a result, the government is now seeking to change clauses that require the Uganda Civil Aviation Authority to seek approval from the Chinese lender for its budget and strategic plans.

Another rule that any dispute between the parties will have to be resolved by the China International Economic and Trade Arbitration Commission is also seen as problematic by Kampala.

Attorney General Kiwanuka Kiryowa, playing down the fears of the airport takeover, says there is no cause for alarm because no property of Uganda has been mortgaged. He added that the loan was a commercial contract with an obligation to both parties.

“When you borrow money, your obligation is to pay. If you do not pay, the other party can take you to court, in which case this would be CIETAC,” he said.

“Let everyone do their part. The airport makes money and will meet its obligations.”

The spokesman for Uganda’s aviation regulator and China’s director general for African Affairs in separate tweets denied that the Chinese lender had taken over the airport.

While the AG says the agreement is not unusual and requires no amendment, Planning Minister Amos Lugoloobi has admitted that the loan was poorly negotiated and signed, though he claims the ministry has laid out strong monitoring mechanisms to ensure the country doesn’t slip into debt distress.

“We have restricted borrowing to only critical projects, and we ensure our loan ratio does not go beyond 50 percent of the GDP,” he said.

Uganda’s current debt ratio to GDP is about 45.7%.

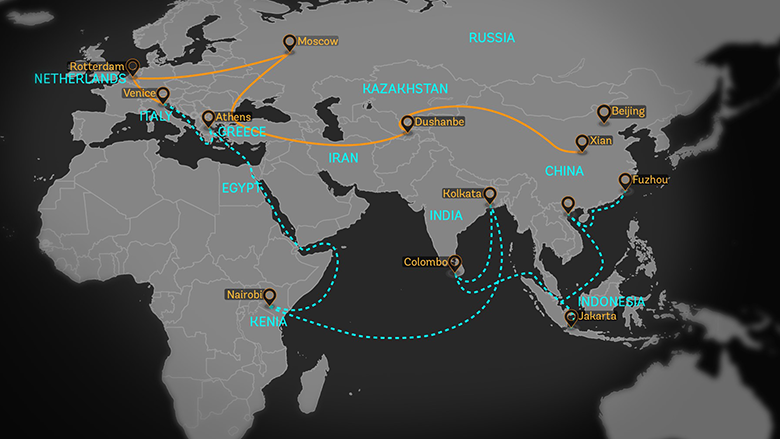

China’s Belt and Road projects have long been plagued with controversy. In 2017, Sri Lanka’s government agreed to lease a port to a venture led by China Merchants Port Holdings for 99 years in return for $1.1 billion. In Pakistan, plans originally to build roads, railways, pipelines, a seaport and the largest airport in the Asian country are yet to be actualized.

In June, U.S. President Biden launched his Build Back Better World, or B3W, plan with the goal of creating “a values-driven, high standard, and transparent infrastructure partnership” to help finance projects in developing countries. As part of the initiative, America announced it would invest in five to 10 large infrastructure projects in the world.

The G-6 B3W initiative is aimed at narrowing the $40 trillion in infrastructure investment that developing countries will need by 2035 and providing an alternative to Chinese borrowing practices that are widely seen as problematic. The United States will offer developing countries “the full range” of U.S. financial tools, including equity stakes, loan guarantees, political insurance, grants and technical expertise to focus on climate, health, digital technology and gender equality.