Zambia’s government has reached an agreement with the China Development Bank (CDB) to defer debt repayments that were due this month on a loan it received from the lender.

According to the finance ministry, Zambia owed CDB nearly $391 million at the end of last year, which is just a tenth of the total $3 billion it owes Chinese entities.

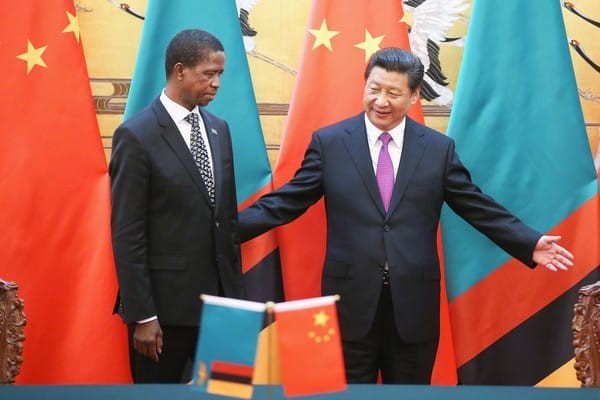

China hold 25% of Zambia’s foreign debt.

In a statement, the ministry said, “Under the terms of our agreement with CDB, interest and principal due on 25th October 2020 will be deferred.

“The deferred interest payment is now payable on 25th April 2021 and the deferred principal rescheduled over the life of the facility.”

Despite being the second largest copper producer in the world, Zambia has been plunged into a debt crisis as a result of years of mismanagement of public funds, ravaging effects of the coronavirus pandemic and a fall in global copper prices.

That led President Edgar Lungu’s government to announce that “public borrowing had become unsustainable.”

The news on deferral of payments had little effect in stirring up Zambia’s sluggish bond market that had already slowed down even before the pandemic. They are now trading at just 40% of their face value.

The government also missed a $42.5 million coupon payment on one of its Eurobonds that was due on October 14, but has a 30-day grace period before it goes into default.

The Ministry of Finance requested Eurobond holders to defer interest payments until April 2021, but they rejected the request.

However, they have now succeeded with other key lenders such as China to reschedule payments.

“This is a good step in the right direction but they still need to do more to appease the creditor group,” said one of the members of the Zambia External Bondholder Committee, Kevin Daly at Aberdeen Standard Investments in London.

“It is still piecemeal and what you need is something comprehensive.”

Zambia’s external debt is nearly $12 billion, including $3 billion of outstanding Eurobonds, $3.5 billion of bilateral debt, $2.9 billion of other commercial debt and $2.1 billion owed to multilateral institutions.