The Great Lockdown will go down in history as an economic depression only comparable to that of the Great Depression, except this time no economists or market commentators saw it coming. Unlike the 2008 subprime mortgage crisis where bells were rung, such as the University of Chicago’s Raghuram Rajan’s paper warning that the financial system was taking on potentially dangerous levels of risk as far back as 2005, nobody predicted COVID-19. With the blindsided nature of this pandemic, and countries grappling to keep their economies afloat, now is a perfect time to evaluate Africa’s ‘friends’.

Over the past decade one friend to the continent has stood out: China. The story begins in 1995, when the famed China Eximbank was given sole responsibility for concessional loans, a new foreign aid instrument. At the time these loans fetched a fixed interest rate, ranging from 2% to 3%, with a grace period of 5 years plus a repayment term of about 20 years. In a rather calculative move, the Chinese budget for foreign assistance subsidized the difference between the Eximbank’s costs and the fixed interest rate, meaning excess liquidity could be pushed towards lending. In this move, the Chinese Eximbank did what the West hadn’t managed to achieve; it lent with haste. Momentarily, the wind was in the sail and the Sino ship was Afro-bound.

In 2007 China had established the China-Africa Development Fund (CADFund), operated by the China Development Bank. CADFund is the pioneer Chinese equity investment fund that focused on investments in Africa. The CADFund presented a fascinating approach where it directly invested in Chinese firms that have economic and trade activities in Africa, as well as Chinese firms that have invested in African businesses and projects through equity investments and quasi-equity investments, such as preference shares and convertible bonds.

In 2011 there was a riveting headline on the BBC; the reporting showed that China had lent more to Africa than the renowned World Bank. Between 2000 and 2014, Chinese investment in Africa jumped from a meagre 2% of what the US was investing to a staggering 55%. The official figures for the previous year, 2010, showed selected countries where China had by far trounced the Bretton Woods institution. In Cameroon the World Bank lent $30 million, where China lent $743 million. Over in the Republic of Congo the World Bank stood at $25.5 million, with China at $75.8 million. In Ghana the World Bank availed $313 million, while China pushed $9.87 billion. In Nigeria World Bank lent $890 million, and China lent $900 million. China had announced its arrival on the continent as an alternative lender, but more intriguingly upon interacting with a technocrat and asking them why they would rather opt for Chinese loans, he simply responded saying “They ask less questions.” In a somewhat complimentary tone, the former chief economist at the Africa Development Bank and Zimbabwe’s current Finance minister, Mthuli Ncube, remarked that the Chinese model “is a fascinating and new model in terms of how aid is flowing into Africa and how infrastructure investment is being conducted and supported.” China, he said, is “posing a challenge and making us think about aid architecture, this kind of governance‐neutral approach to aid engagement and investment in Africa.” In a rather candid interview, President Johnson Sirleaf’s former adviser revealed that despite Liberia continuously asking development partners for aid money to build the war-ravaged roads, none of them would finance infrastructure projects until the Chinese willingly bankrolled the ‘Liberian road’ refurbishment project. In plain terms, the Chinese model has a different rick quantification method. They may be asking less questions, but the Chinese also are willing to put their money where no one else will dare go.

Virus hits ‘lender’ and ‘borrower’

The scariest facet of the Great Lockdown is its dissimilarity to the last economic crisis in recent memory. Following the 2008 crisis many investors clogged their portfolio with emerging market stocks, bonds and Exchange Traded Funds (ETFs) as emerging markets had relatively more attractive returns. The logic being the fact that many developed economies opted to cut their repo rates to near zero; this rather drastic monetary policy tact saw investors migrate their investments to emerging markets which offered more lucrative returns. South Africa led the rally on the continent with the ‘Asian Dragons’, namely Hong Kong, Singapore, South Korea and Taiwan. It should be noted that bond yields are significantly affected by monetary policy. Because interest rates ultimately determine the risk-free rate of return, and the same risk-free rate of return has an immense impact on the demand for all types of financial securities such as bonds, developed economies cutting interest rates to the in the wake of the 2008 financial crisis had a trickledown effect as falling interest rates make bond prices rise and bond yields fall. It’s these lower yields that saw fund managers migrate their portfolio towards emerging markets whose interest rates were above zero for starters. As a result, we saw emerging market hard currency denominated debt rise to $200 billion in 2017 alone, and close to 70% of the government paper was issued in dollars. With US and bond yields at alarming lows, US bonds were no match for emerging markets.

The stark contrast this time round with the Great Lockdown is that we are experiencing lockdowns from Moscow to New York, there in questioning whether capital flight will, as it did in the 2008 financial crisis, find its way to emerging markets. Given the widespread nature of this crisis developing, developed and emerging markets have all had to act hastily on both the fiscal and monetary front, and as a result almost all economies irrespective of size have cut their repo rates. In so doing, dimming the prospect of ‘cheap money’ to developing and emerging markets as was the case in the 2008 financial crisis.

The Chinese dilemma

On the on April 14 this year, the International Monetary Fund unexpectedly approved about $500 million to cancel six months of debt payments for 25 countries. Of these 25 countries, 19 were African. Despite the continued cruelty towards Bretton Woods institutions for the structural reform programmes in the past, the relief in the Great Lockdown left many critics aghast. Recent estimates have shown that about 20% of all African debt is Chinese debt. This leads to the pertinent question: Who are Africa’s true friends?

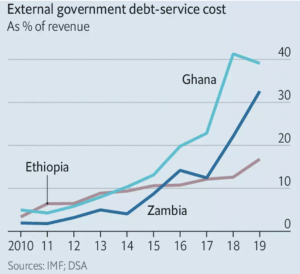

On the 17 June 2020, H.E. Xi Jinping delivered a keynote speech at the extraordinary China-Africa summit in Beijing addressing solidarity against COVID-19. He highlighted that: “within the FOCAC framework, China will cancel the debt of relevant African countries in the form of interest-free government loans that are due to mature by the end of 2020. For those African countries that are hardest hit by the coronavirus and are under heavy financial stress, China will work with the global community to give them greater support, by such means as further extending the period of debt suspension, to help them tide over the current difficulty.” This statement poses a certain level of scrutiny in regards to who qualifies for suspension, and ultimately whether radical actions such as debt asset swap claims will be on the table. This was reportedly explored for the case of Zambia, which stood at a mammoth $11.2 billion in debt in January 2020, up from $4.8 billion just five years earlier. It is also critical to examined China’s loan facilities to Africa in the past as some of these have been non-concessional in nature, fetching market-based interest rates. Looking at the past Forum on China-Africa Cooperation (FOCAC) meetings the commitments tell a troubling story. Take for instance the 2006 FOCAC pledges where 50% of the financing was concessional in nature. Going with the textbook definition that concessional facilities are extended on terms substantially more generous than market loans, and boast interest rates below those available on the market or by grace periods, or a combination of these; this begs questions on the rate the rest of the financing was reached at. This query of loan composition is confirmed by the Brookings institute, which notes that zero-interest loans make up only a small portion of Africa’s debt owed to China. Between 2000 to 2017, China provided $143 billion in loans to African governments. According to their study of the $60 billion China pledged to Africa at the 2015 FOCAC concessional loans, credit lines, and African small and mid-sized enterprise loans jointly constitute 70% of the total, with only 9% of the announced funding in zero-interest loans.

We cannot ignore Beijing’s resolve and efforts during the Great Lockdown, as the Chinese government through the Chinese Foreign Ministry affirmed that China committed a $2 billion donation to cover public health, poverty alleviation and economic recovery across the continent. While this is an appreciated and welcomed gift, we also cannot overlook that the current system of loans and debt is stifling African countries growth. What Africa needs now is less debtors knocking on her doors when she’s nursing her children.

It should be noted, however, that China is not the Paris club and they do not agree to write-offs. Even if it did, the estimate that stands at more than $150 billion lent to Africa between 2000 and 2018, according to the China Africa Research Initiative at Johns Hopkins School of Advanced International Studies, makes write-offs a tough sell. Despite Beijing having a tough stance on write-offs, China has in the past forgiven about $3.4 billion worth of African debt between 2000 and 2019. In addition, the recent G-20 concession offers a ray of hope as the Chinese government agreed to the eight-month debt moratorium agreed for poor countries as part of the G-20.

But in the wake of the COVID-19 pandemic, is debt suspension enough for Africa’s ‘friends’? Or do our creditors need their dues now more than ever? An exploration of the composition of much of Africa’s debt shows that few African countries, such as Zambia, owe most of their debt to China with the overall composition being a combination of bilateral and multilaterals lenders. Other powerhouses, such as Kenya and Nigeria, have in the past decade reinforced their private debt composition offering a more diversified debt outlook. In this light, debt waivers and suspension endeavours need be a collective public and private effort.

A deeper examination of the moratorium also shows that there are no restructuring options of already existing debt. Although Africa currently carries a mere 4.6% of the global COVID-19 cases, estimates show that her health expenditure is a meagre 1% of global health expenditure. To this end, the United Nations Economic Commission for Africa estimates that the continent will need a $100 billion stimulus package to kick-start its health system, further dimming the picture of the continent’s fiscal space in light of the on-going pandemic.

But as Africa asks for waivers, now is also a time to examine the returns from the investments, if any. The Belt and Road Initiative alone, according to a report from the United Nations’ Conference on Trade and Development, saw China’s foreign direct investment in Africa increase 44% to $46 billion. With this, one can’t help but wonder; Are any of these projects yielding results? Fostering economic Arbitration? Or are they ‘pumping the prime’, where governments stimulate their economic growth, often during a recessionary period, through increased government spending?

COVID-19 is a stark reminder that Africa’s woes cannot be answered by her ‘friends’ alone waiving her debt, but it will take a multi-faceted approach involving multilateral, bilateral lenders, governments and most importantly the private sector to work in unison.

Cover photo by Lintao Zhang/Pool/Getty Images